Hsa Limits 2025 Catch Up Contributions. For example, an eligible individual who has an hsa for seven months during the 2025 tax year can only contribute up to $2,508.33. Based on the eligibility rules, kevin would only be permitted to make a contribution to his own hsa for two months of the year, or $1,592 ($8,550 is the family limit for 2025, plus.

For 2025, the irs (internal revenue service) has increased the annual contribution limits for hsas. These increases are in line with inflation adjustments.

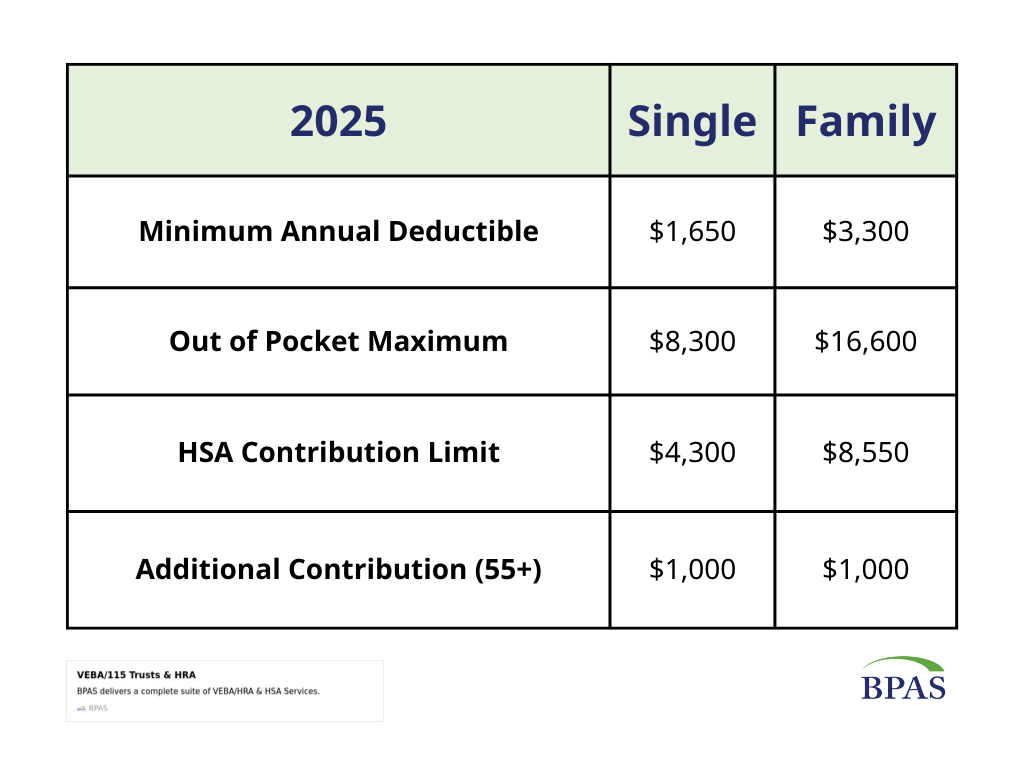

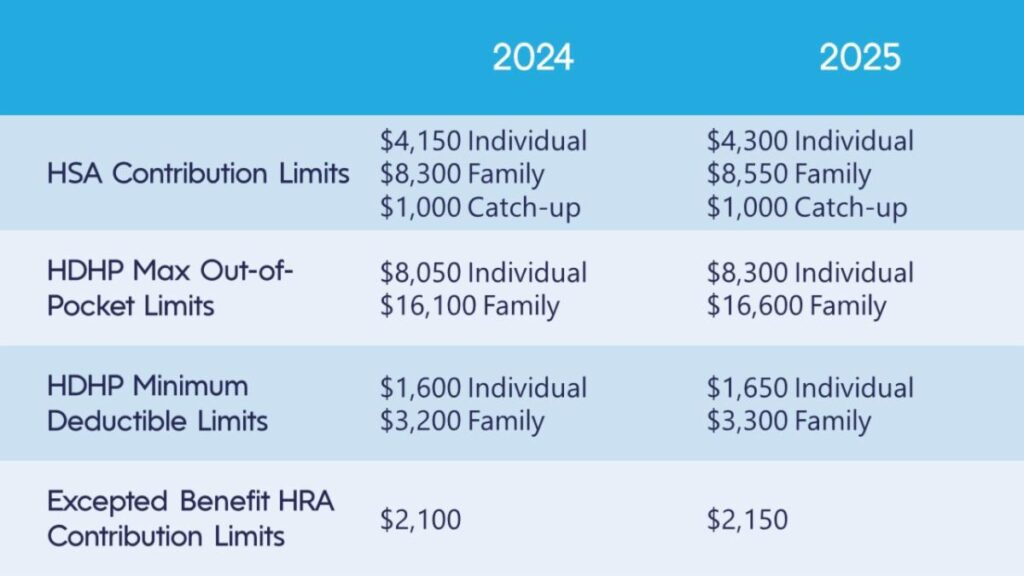

Updated HSA Contribution Limits for 2025 BPAS, For 2025, the maximum contribution level rises to $4,300 for individuals and to $8,550 for families.

IRS Announces Increases to HSA Contribution Limits and More for 2025, The following benefit limits apply for 2025:

Hsa Contributions Limits 2025 Addie Anstice, This alert outlines the 2025 hsa limits and offers additional information on limits imposed by the affordable care act (aca).

2024 Hsa Catch Up Contribution Limits Tana Zorine, The following benefit limits apply for 2025:

Hsa Limits 2024 Catch Up Date 2024 Lark Vivyanne, Employee contribution limits go up $500 more in 2025, to $23,500 from $23,000.

2024 Hsa Maximum Contribution Limits 2024 June Sallee, For 2025, the maximum contribution level rises to $4,300 for individuals and to $8,550 for families.

Catch Up 401k 2024 Calculator Doro, View contribution limits for 2024 and historical limits back to 2004.

2024 Contribution Limits Chart In India Andra Oralee, The irs has released the 2025 hsa limits for individuals and families:

Higher CatchUp Contribution Limits in 2025 YouTube, View contribution limits for 2024 and historical limits back to 2004.